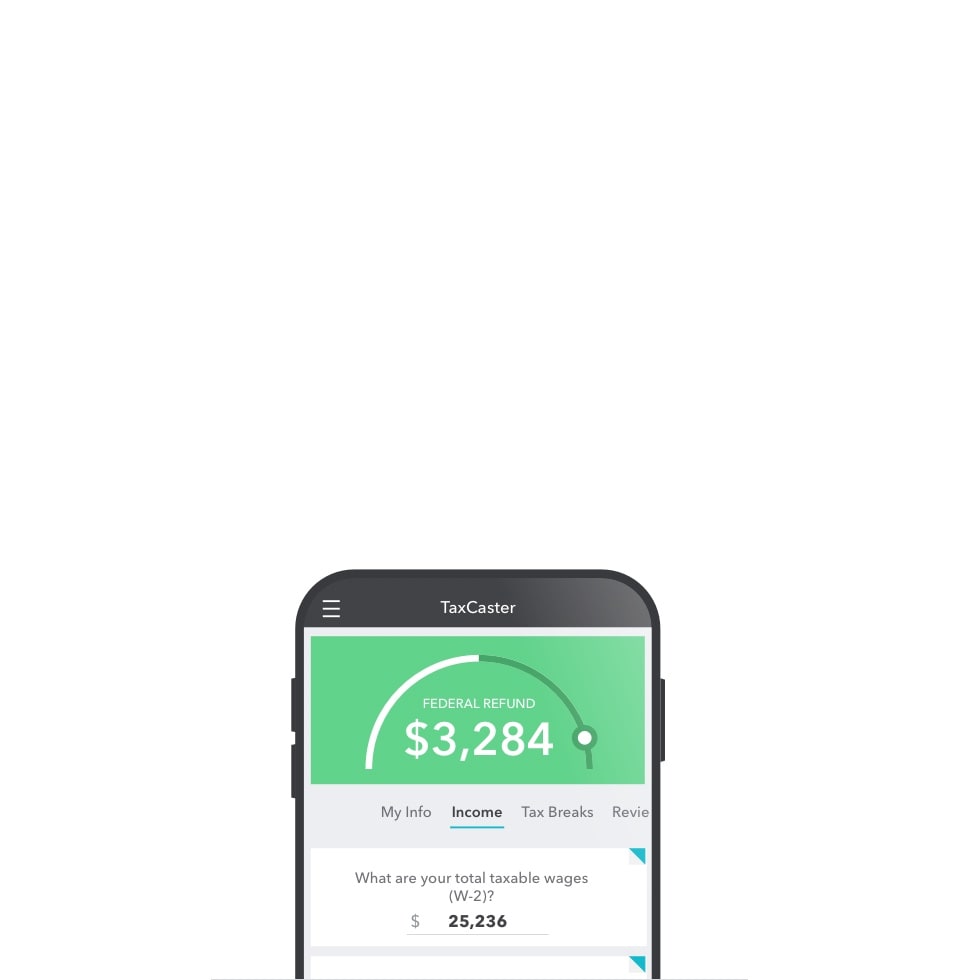

All quarterly payments and with holdings, as well as applicable tax credits, will be applied and deducted from the outstanding amount. This will prompt you to generate an overall refund or unpaid amount. It does this by deducting your tax deduction from your tax exemption. TaxCaster’s technology allows you to calculate the net amount of taxable income. TurboTaxTaxCaster is also an income tax calculator.This helps reduce federal unpaid amounts. Tax exemption is one of Turbotax TaxCaster’s strengths. How to estimate what the tax refund will be.You can use the TurboTax Refund Calculator for free!.Using TaxCaster for AMT tax calculation.If you are just here to get your 2022 Taxes prepared and e-Filed please Start Your 2022 Return(s) now at. In case you have any tax questions, contact an Taxpert ® before, during, or after you prepare and e-File your returns.Got different tax calculator results and not sure what to do? Compare Taxpert ®, TurboTax ®, H&R Block ®, etc.Got more Tax questions? Let's DoIT together: IT is Income Taxes.

Simply access these Tax Calcualtor Tools now. does a person qualify to be a Dependent on your return, or, do you qualify for the Earned Income Tax Credit and/or the Child Dependent Care Credit etc. These 15 free 2022 tax tools will provide you personal answers to your specific tax questions e.g. How does Less Tax Mumbo Jumbo sound to you? DoIT Less Taxing: IT is Income Taxes. Then get your personal Tax Refund Anticipation Date - or when can you expect your Tax Refund in your bank - based on your 2023 tax refund e-File Date. Use this 2022 tax calculator to estimate your tax refund or taxes owed. This tax calculator is for 2022 Tax Returns due in 2023 and is constantly being updated with the latest IRS finalized 2022 tax data.

0 kommentar(er)

0 kommentar(er)